Making a car sharing business profitable requires balancing consistent revenue streams against the significant costs of operating a vehicle fleet. While the service appears simple to the user, the financial engine behind it relies on high vehicle utilization and strict cost control.

By the end of this lesson, you will have a clear picture of the car sharing financial model. We will explore the main revenue sources, break down the critical direct and fixed costs, and identify the specific levers you can pull to ensure your business generates a healthy profit.

Defining the Financial Model

Many operators focus heavily on the technology or the customer experience. However, long-term success depends on understanding the Profit and Loss (P&L) statement for your city or region. This financial blueprint reveals exactly where your money comes from and where it goes. Understanding these numbers is often the difference between a growing business and one that burns cash.

It begins with Gross Revenue, which is the total amount paid by customers. However, the money you actually keep to run the business is Net Revenue, which is your gross revenue minus sales taxes. This is your real starting point.

From there, you must subtract Direct Costs. These are "variable" costs that only occur when a vehicle is used, such as fuel, electricity, cleaning, and specific trip repairs. If a car sits idle, these costs are zero. The money remaining after paying these direct costs is your Contribution Margin. This number is critical because it tells you if your core service is actually making money on each trip.

Next come Fixed Costs. These are "indirect" costs you must pay whether the car moves or not, including insurance, vehicle financing (lease/EMI), and the connectivity tech stack. Finally, you account for provisions, which are funds set aside for unexpected losses like theft or unpaid bills.

Your Gross Margin is what remains after all these fleet-level costs are paid. This final amount is not yet pure profit; it must be large enough to cover your company’s central costs, such as office rent, software, and headquarters staff.

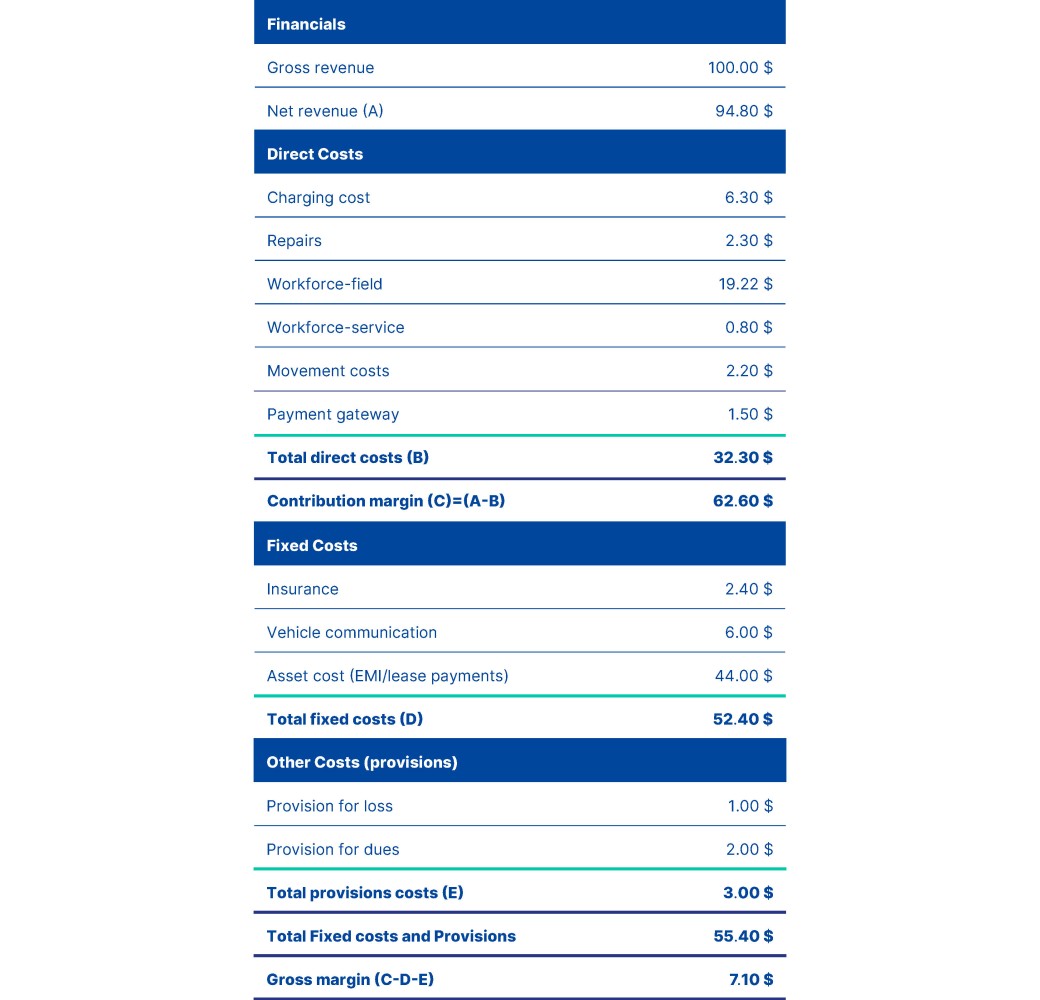

The following chart shows a typical P&L for a car sharing service in a city:

The Four Pillars of Revenue

While usage fees are the most obvious income source, a resilient car sharing business relies on a mix of four revenue streams to ensure stability.

The core engine is Usage Fees. Operators typically charge by the minute, hour, or day, often adding a per-kilometer fee for longer trips. This structure allows you to monetize various needs, from short errands to weekend getaways. The most critical metric here is Vehicle Utilization. A car that generates revenue for only 30 minutes a day will likely lose money, whereas achieving three to five paid hours often leads to profitability.

To counter the unpredictability of daily demand, successful operators introduce Subscriptions and Memberships. By offering monthly plans that unlock lower usage rates or reduced insurance deductibles, you generate recurring revenue. This steady cash flow helps smooth out seasonal dips and builds a loyal customer base that is less likely to switch to competitors.

Corporate and B2B Partnerships provide a third layer of security. Instead of hunting for individual drivers, you can contract with companies to replace their fleet or taxi expenses. Similar deals with real estate developers or universities can secure guaranteed usage minimums or valuable perks like subsidized parking.

Finally, Ancillary Fees exist to protect your margins rather than drive profit. These include charges for heavy cleaning, damage processing, or managing traffic fines. These fees ensure that the cost of bad behavior is paid by the responsible user rather than eating into your operational budget.

Drivers of Profitability

Generating revenue is not enough. You must convert that income into profit. To bridge the gap between breaking even and making money, successful operators focus on three specific drivers: utilization, pricing, and operational control.

First, you must secure enough paid usage per vehicle. A car available 24 hours a day generates costs every minute, but it only generates revenue when a customer drives it. Industry data suggests that if a car is used for only 40 minutes a day, the business will likely struggle.

Second, your pricing strategy must account for dead time. Your rate per hour cannot simply cover the direct costs of that hour; it must also subsidize the time the car sits idle. Operators often combine time-based rates for short city trips with distance-based fees for longer journeys. This ensures that high-mileage trips, which cause more wear and tear, remain profitable.

Finally, you must maintain strict operational control. Even with high demand, inefficient operations can erode margins. Common pitfalls include poor rebalancing (moving cars to the wrong areas) or having a fleet that is too large for the current demand. Profitable operators use data to constantly adjust fleet size and optimize service routes for cleaning and refueling, ensuring no money is wasted on unnecessary tasks.

Understanding Costs and Risks

Profitability is not just about earning revenue. It is about managing the costs that drain your account. In car sharing, expenses fall into two distinct categories: direct costs and fixed costs. Understanding the difference is vital because one scales with your success, while the other must be paid even if your fleet never moves.

Direct costs are variable expenses linked to vehicle usage. Every time a customer books a trip, you incur costs for fuel or electricity, payment gateway fees, and wear and tear. This category also includes your field workforce which are the teams responsible for cleaning, refueling, and moving vehicles from low-demand to high-demand areas. If a vehicle sits idle, these costs remain low. The money left after paying these expenses is your contribution margin, which funds the rest of the business.

Fixed costs, or indirect costs, are the financial baseline you must cover every month. The largest portion is typically the asset cost which includes the lease or financing payments for the vehicles themselves. Building an electric fleet will also increase your fixed costs.

You also pay for insurance and the vehicle communication technology that tracks your fleet. Because these costs do not change based on usage, they pose the biggest risk during low-revenue periods.

You must also account for provisions. This is money set aside for inevitable operational losses, such as insurance deductibles for stolen vehicle parts or unpaid customer bills. Finally, every operator faces the challenge of seasonality. Demand for car sharing fluctuates significantly, with gross revenue often dropping by up to 50% during the off season. Interestingly, when this off season happens differs from region to region. In some regions, the colder months see lower use while in other areas, this is the time when most rentals are booked. Since your fixed costs remain the same year-round, you must generate enough profit in the high season to survive the low season.

Future Revenue Opportunities

As the industry matures, innovative operators are looking beyond standard usage fees to find new sources of income. These emerging revenue streams often leverage the data your fleet generates and the physical presence of the vehicles themselves.

One accessible opportunity is vehicle advertising. Your cars act as moving billboards that travel through high-visibility urban areas. Selling branding space on the vehicle exterior allows you to generate passive income without disrupting daily operations. Additionally, government subsidies are becoming a viable funding source. Many municipalities view car sharing as a critical tool for reducing private car ownership and lowering emissions. Operators, especially those running electric fleets, can often secure grants or operational funding for contributing to these public sustainability goals.

Perhaps the most valuable untapped asset is data. Modern telematics units capture vast amounts of information about traffic patterns, parking availability, and travel habits. When aggregated and anonymized to protect user privacy, these insights become a marketable product.

Data can also be used to protect your fleet, as Chilean operator Wift experienced with their subscription service. By using car sharing telematics data they were able to fully recover 95% of their stolen vehicles, thereby protecting their fleet’s value.

Insurance companies analyze this data to refine risk models, while city planners use it to optimize urban infrastructure. Even large retailers, such as furniture stores, value insights on customer movement to better plan store locations. By treating these insights as a product, you can build a high-margin revenue stream that complements your core rental business.

Key Takeaways

What is the financial foundation of a car sharing business?

Success begins with understanding your Profit and Loss (P&L) statement. You must distinguish between Gross Revenue (total sales) and Net Revenue (sales minus tax), and focus on your Contribution Margin, which is the profit remaining after paying the direct costs of every trip.

Where does revenue in car sharing come from?

While usage fees (per minute/hour/kilometer) are the core income, stable operators diversify with subscriptions for recurring revenue, B2B contracts for guaranteed minimums, and ancillary fees to cover operational variances.

How does a fleet become profitable?

Profitability typically requires three things: achieving 3–5 paid hours of utilization per vehicle per day, setting prices that cover both direct costs and dead time, and maintaining strict control over operational expenses like rebalancing.

What costs should I be most worried about for my car sharing service?

There are two types of cost: Direct costs (fuel, cleaning, repairs) only occur when a car is used. Fixed costs (vehicle financing, insurance, technology) must be paid every month regardless of usage, making them the biggest risk during low-demand seasons.

How can I generate revenue beyond just renting cars?

Beyond rental fees, operators are increasingly generating income by selling advertising space on vehicles and monetizing anonymized fleet data for insurance and urban planning insights.