How do we measure the size of the car sharing market?

The global car sharing market is very complex, has diverse market characteristics and is not equally distributed across the globe.

As described in previous lessons, operators run various business models that include station-based, free-floating, P2P, corporate car sharing, and other models. Often operator business models are also mixed. This can include mixtures between different car sharing models (like a hybrid model between station-based and free-floating for instance) or mixes and gray zones between car sharing and other mobility services (for instance between car sharing and rental).

Therefore, it is rather complex to estimate the status and progress of the global car sharing sector. To get a first feeling of the distribution of global car sharing, we can analyze the available fleet sizes in free-floating and station-based car sharing, as they tend to have the best public and comparable data availability.

Global distribution of car sharing

Globally, the market research agency Berg Insight estimates that there are roughly half a million car sharing vehicles in station-based and free-floating services as of end of 2024. In comparison: They estimate that the market has grown by the factor of 5 since 2014 when the market hit 100,000 vehicles.

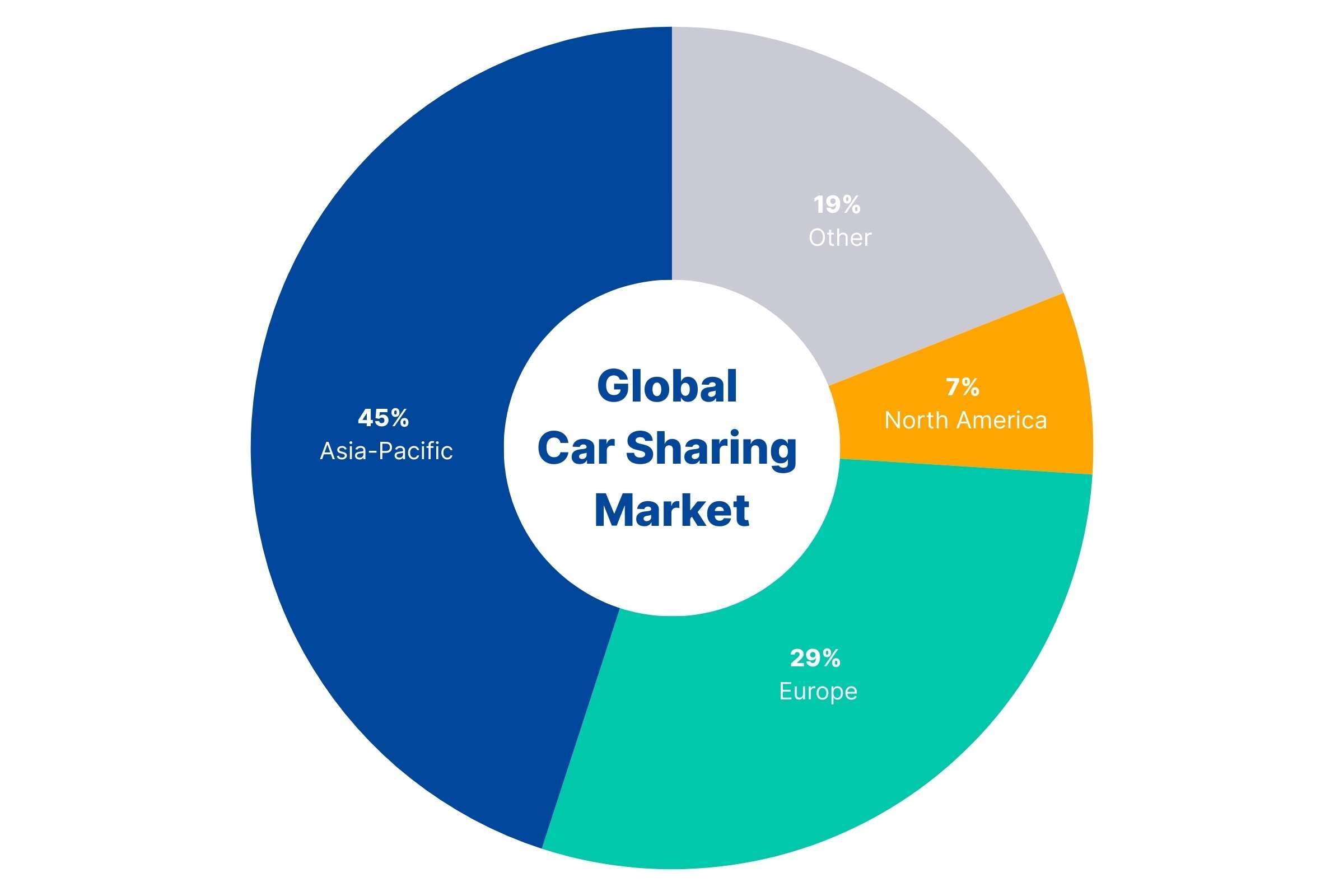

Today, the largest global car sharing regions are Asia (especially East Asia stands out) as well as Europe, and North America. 45% of global car sharing vehicles are currently deployed in Asia and 29% in Europe.

The largest national car sharing markets include Russia, Japan, Germany, South Korea, and the USA (combined station-based and free-floating fleet size).

Beyond station-based and free-floating car sharing, P2P and corporate car sharing show large quantities of fleet size, users and usage. Hundreds of thousands of private vehicles are offered annually on global P2P car sharing platforms. Corporate car sharing is currently estimated to have more than 140,000 vehicles globally. It is currently growing fast in many countries.

Deep dive: Asian car sharing

Asia is the largest global car sharing region if we compare total fleet sizes. The region accounts for 45 % of the global combined station-based/free-floating car sharing vehicles, according to Berg Insight.

Especially the East Asian car sharing arena stands out in terms of global fleet numbers. Japan, South Korea, Taiwan, and China are global top markets. The station-based car sharing company Times Car in Japan is considered offering the largest global non-P2P car sharing fleet (>50k) vehicles.

Other markets such as Türkiye, Singapore, or some markets in the Middle East hold strong car sharing cultures. Singapore for instance, has a very high per-capita rate of car sharing cars, showcasing the favorable conditions for car sharing in the region. The small city-state alone, has more than 6,000 car sharing cars.

In a recent white paper, we analyzed more than 60 car sharing operators across East and Southeast Asia. Strong brands in East and Southeast Asia include Times Car, SOCAR, G Car, iRent, Mitsui Car Shares, GetGo, or GoSmart.

Deep dive: European car sharing

European car sharing is the cradle of global car sharing. Many pioneers come from the continent and many of them are still available today after 30+ years of car sharing operations.

In a nutshell: In 2025, European car sharing was available in at least 42 countries. The region shows the largest diversity of operator brands. In our 2025 European Car Sharing Barometer, we analyzed 470+ station-based operators, around 80 free-floating operators and 40+ P2P operators across Europe. In total, Europe holds more than 129,000 vehicles (62,000 station-based and 67,000 free-floating) as of 2025 (+8% to 2024). Further substantial numbers of cars come from P2P and corporate car sharing models. Hundreds of vehicle models are available to European car sharing users.

The European top 5 (combined station-based and free-floating) markets are Germany, France, Italy, Belgium and the Netherlands. Germany alone accounts for more than 1/3 of the European fleet size and can be considered the lead market with its large fleet size, operator variety, and car sharing history.

Deep dive: North American car sharing

The first car sharing experiments started in the US in the 1980s, with initiatives like Purdue University’s Mobility Enterprise and Short-Term Auto Rental (STAR) in San Francisco. Auto-com (today Communauto) launched in Canada in 1994. CarSharing Portland was a pioneer in the space in the US in 1998. In Mexico, Carrot introduced a car sharing service in 2012.

In a white paper on the regions strong car sharing market, we analyzed more than 60 car sharing brands across the USA, Canada and Mexico. According to Berg Insight, approximately 9 % of the global car sharing fleet comes from North America.

Strong operator brands include Communauto, Zipcar, Turo, Enterprise CarShare, Evo, Modo, Free2move, Kinto Share, Punto, Drivana, and Keko.

Outro: Other markets

In most other global regions, we can find additional car sharing operations and cultures. Especially the Russian market stands out with an estimated 70,000+ car sharing vehicles from free-floating services. The availability of car sharing is starting to grow in markets like South America and Africa. However, total and relative numbers are still lower than in top markets across like Europe, East Asia, North America, or Russia.